As 2025 comes to a close, it’s a good time to review how China’s travel and digital landscape have evolved this year. Below are two key market updates offering timely insights into both pre-trip inspiration and in-trip decision-making, which may help support marketing planning for the year ahead.

rednote: From Chasing the Perfect Shot to In-Depth Travel

rednote (also known as Xiaohongshu or Little Red Book) remains a go-to platform for Chinese Mainland travellers when researching for trips. With over 100 million travel-interested MAU on the platform, users typically review 50+ posts during pre-trip research to understand what a destination truly offers. As reliance on the platform continues to grow, shifts in rednote travel trends are increasingly influencing what travellers prioritise when building their itineraries.

Just a year ago, travel behaviour on the platform was largely shaped by trends such as “一生都要出片的中国女人”, which celebrated picture-perfect moments. Travellers prioritised photogenic locations, sophisticated outfits and viral shooting angles, all in pursuit of share-worthy content. Over time, this emphasis on polished visuals made travel feel increasingly curated, leading users to question whether this was still how they wanted to experience a destination.

This year, travel content on rednote shows a clear shift toward experiences that are valued for personal and meaningful qualities. Trends like “#不为打卡的旅行” signal a move away from rigid, photo-driven itineraries. Travellers are now focusing on interest-led discovery, slower-paced journeys and in-depth travel that blends into local rhythms — shaping both what they seek from a trip and the type of information they look for during the planning stage.

Amap: A Growing Presence in Hong Kong

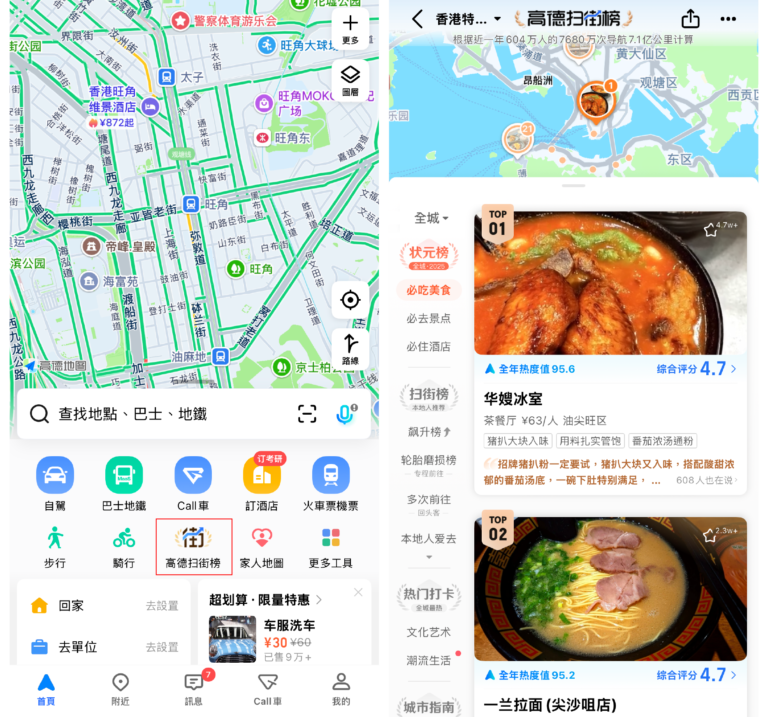

Amap (高德地圖) made headlines in early September with the launch of its new “高德扫街榜”, a feature that quickly sparked discussion across social platforms. For many users, it was an unexpected move for a navigation App entering the ranking space — something traditionally associated with Dianping. The launch signals Amap’s growing role in how people discover, access and decide where to go during their journeys.

For those less familiar with Amap, its scale and influence across China are often underestimated. According to QuestMobile’s September 2025 rankings, Amap is among the top 4 most-used Apps nationwide, just behind WeChat, Taobao and Alipay, and far ahead of Baidu Map. Often described as China’s Google Map, Amap is deeply integrated into everyday life, supporting real-time navigation, location search and nearby discovery. As a high-frequency, utility-led App, Amap is particularly well suited to industries where real-world presence and on-the-ground discovery matter.

Unlike platforms that rely on written reviews or ratings, Amap’s rankings are generated from real-world behavioural data, reflecting the places people actually visit, pass by or spend time around. This offers a genuine form of “用脚投票”, based on actual foot traffic rather than stated preference. Because travellers frequently open Amap during their trip to navigate and explore, the platform captures real-time in-trip moments, placing it closer to the lower funnel where decisions are made on the spot. As a result, Amap becomes a valuable touchpoint for reaching travellers once they are already in Hong Kong — a stage of the journey that many platforms struggle to cover.

Beyond rednote and Amap: Shaping the Full Travel Journey

Other China digital platforms also offer valuable touchpoints for reaching Chinese Mainland travellers at different stages of their journey. Dianping, for example, continues to focus heavily on its coupon and review ecosystem, with many shopping malls in Hong Kong already present on the platform. Meanwhile, traditional OTA platforms such as Ctrip continue to expand their advertising solutions, providing brands with more precise options to engage travellers throughout the booking process.

Together, platforms such as rednote, Amap, Dianping and Ctrip play distinct roles across different stages of travel, from pre-trip inspiration to in-trip actions, creating new opportunities to engage Chinese Mainland travellers. As traveller behaviours continue to evolve, follow us on Facebook and LinkedIn for the latest market insights. If you’re planning for 2026 and would like to explore strategies that align with the latest traveller behaviours and market dynamics, feel free to get in touch with INITSOC, your trusted China marketing partner.